One crucial feature that defines any network is its security. A network with awesome security will be less susceptible to hackers. That’s what defines the hash rate, an indicator of the healthiness of the BTC network at a specific time. It sums up the computing power of any network through crypto mining, including the BTC network.

Miners use this computing power to confirm transactions and secure the network in a process known as crypto mining. Thus, the security of a network is proportional to the amount of contributed computing power. The BTC network hash rate hit a new ATH of 248.12m TH/s this past Saturday. However, the latest blockchain.com data showed that there had been a slight dip, and it’s now about 209.7m TH/s.

BTC Hash Rate And BTC Price

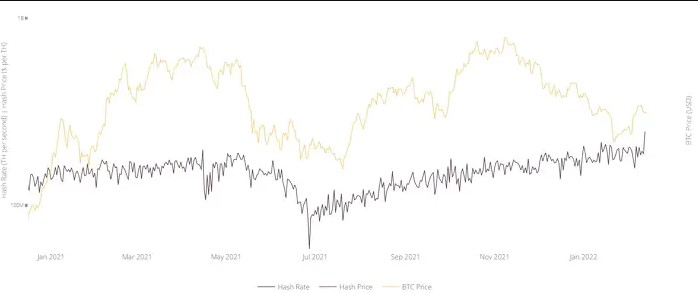

BTC hash rate and BTC price chart. Source: Willy Woo

Using the Willy Woo chart shown above for last month shows that BTC hash rate and BTC price have a direct relationship. For instance, when the former dropped by 46.5% in April 2021, the latter declined by 23.5% within the same period. Also, when the BTC hash rate declined by 69.5% in May 2021, when China banned all crypto-related activities, BTC’s price dropped by nearly 49.5%.

The only time the BTC hash rate and the BTC price didn’t affect each other was the BTC bearish run of last month, during which the BTC hash rate kept rising. However, both of them have been rising since last month.

Crypto Mining Industry Update

Last month, the top semiconductor computer circuits manufacturer, Intel, released the Bonanza mine (a new mining rig) to show its intent to become one of the top dogs in the crypto mining space. In other news, ESMA vice-chair, Erik Thedeen, claimed that it is in the best interest of the EU to ban private digital currencies.

Thedeen’s call might reflect the EU’s opinion regarding cryptocurrencies. An august 2021 data from the University of Cambridge revealed that the US now controls most of the global BTC hash rate. A position held by China before its crypto ban policy.

The energy crises in some nations like Kosovo and Kazakhstan negatively impact crypto mining operations in those places. Thus, Kosovo had to ban BTC mining and all crypto-related activities to resolve its energy crisis. Before the ban, the authorities had to declare a 2-month state-of-emergency to reallocate funds for energy imports.

Thus, it issued more power cuts and reduced energy consumption. Per Reuters, Kosovo imports over 45% of its energy. Also, Kazakhstan’s response to its energy crisis was to increase tax levies on crypto miners. Kazakhstan’s decision not to ban crypto mining outright might not be unconnected with the fact that it ranks second among BTC mining countries. The number one ranking goes to the united states.

Thus, an outright ban on crypto mining would mean a significant loss in revenue through taxes. Every country seeks means to reduce energy consumption from crypto mining activities, and the US is also following suit. The tax regulators in the US have proposed a bill to ban PoW mining with a view of forcing networks to switch to PoS, which consumes less energy for mining.