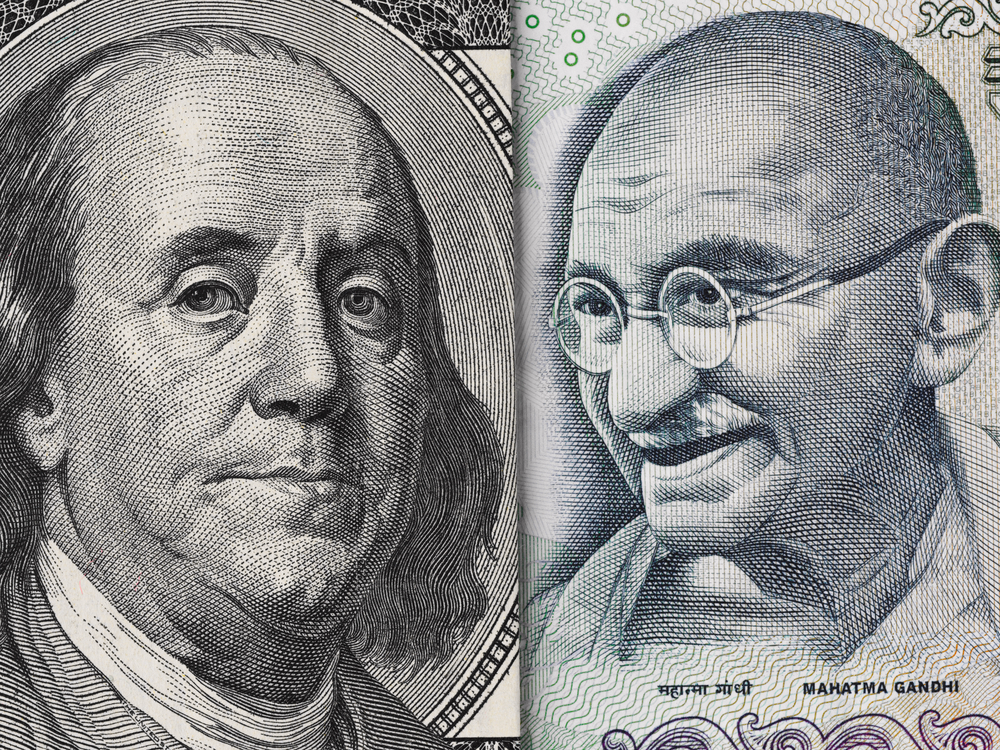

The rupee touched record lows as it tracked the slump in global equities following the hawkish Fed during the Jackson Hole conference.

Indian rupee noted a sharp decline against the USD early Monday after the United States Fed Chair Jerome Powell highlighted maintaining an aggressive rate stance to curb the escalating inflation. The rupee plummeted to 80.11 record low against the United States, compared to the previous session’s closing at 79.87.

Why is Indian Rupee Declining?

United States Federal Chair Powel reiterated (on Friday) the central bank’s dedication to fighting inflation. He also commented on the risks from extended and elevated price growth periods. In response, the ten-yields and rate-sensitive near-end shot up, whereas stocks sold off massively.

Though hiked interest rates, softer labor markets, and slower growth conditions will cool inflation, they’ll also bring pain to businesses and households. These remain the unfortunate costs related to reducing inflation. However, Powell suggested that failure to ensure price stability means more pain.

Nomura Research commented on the latest Fed outlook, saying that Powell’s comments during this year’s Jackson Hole Symposium matched their expectations of the central bank maintaining a hawkish stance despite the economy staring at recession.

Nomura added that it expects the recession to arrive in 2022 Q4, though escalated inflation might lead to extended Fed tightening up to Feb before rate cuts in 2023 Q3. The Indian currency touched the 80.06 previous all-time low last month. Meantime, the USD remains up over 7% against INR in 2022.

Meantime, RBI plans to regulate the upside pace of the currency. The Reserve Bank of India has two plans for preventing massive INR weakness plus avoiding too volatility in the USD-INR. That means they could keep selling the dollar.

Rupee Technical Levels

The USD-INR weekly technical chart shows the pair sustaining beyond the 79.55 resistance. The Relative Strength Index sways past 70 levels, whereas the MACD shows optimistic divergence on the 7-day technical chart.

The technical setup indicated that USD/IRN consolidated within the 79.55 – 80.05 range and seems ready for upside breakouts. Analysts expect the pair to maintain its 78.55 support and test 80.30 – 80.55 on a closing basis.